|

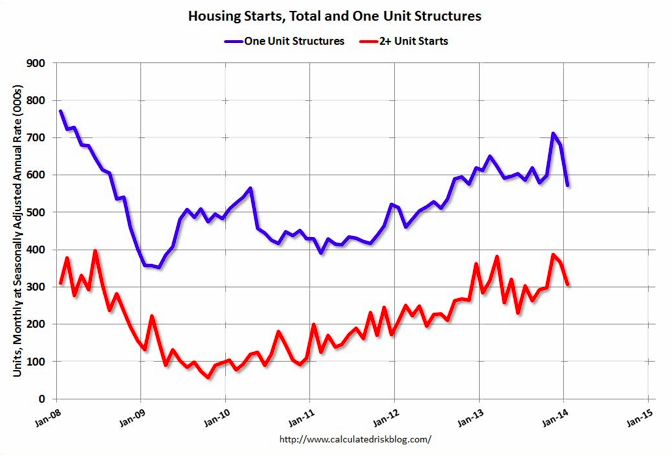

Housing starts declined from 1,048,000 in December 2013 to 880,000 in January 2014. While multi-family starts are more volatile on an month-to-month basis (see figure below from Bill McBride at the Calculated Risk blog), both single and multi-family move together. This downturn in starts coincides with a sharp decline in house-building permits, which are experiencing their longest downturn since the collapse of Lehman Brothers in 2008.

0 Comments

There's a lot of whispering going around about how DPR and Skanska landed the whale-sized new Apple headquarters campus. That's a huge win for them on a high profile project. However, flying under the radar is BN Builders, who landed contracts for an auditorium, fitness center, and R&D space on the new campus. Read about it here. Those projects, while not as newsworthy as the main building on campus, are going to be equally cool buildings (and likely more favored by Apple employees!).

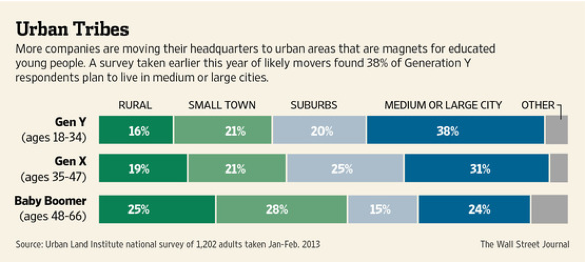

I've known BN's VP of Preconstruction, Nick Pera, for years, dating back to when I was an adjunct professor at Santa Clara University. He's a class act and I wish him and BN the best of luck. Many of the students that graduate from the Sac State Construction Management Department want to stay in the Sacramento area. I don't blame them, I like this area. However, if current trends persist, then for those students that want to pursue a career in commercial building construction, their next stops will increasingly be dense urban areas. Companies are ditching the suburbs for city cores, which will require a lot more construction in those metropolitan areas (office, housing, retail, schools and other services). This will require students to develop skills to work in environments that are difficult for construction. Cities present their own difficulties, and the dense they get, these constraints will continuously escalate.

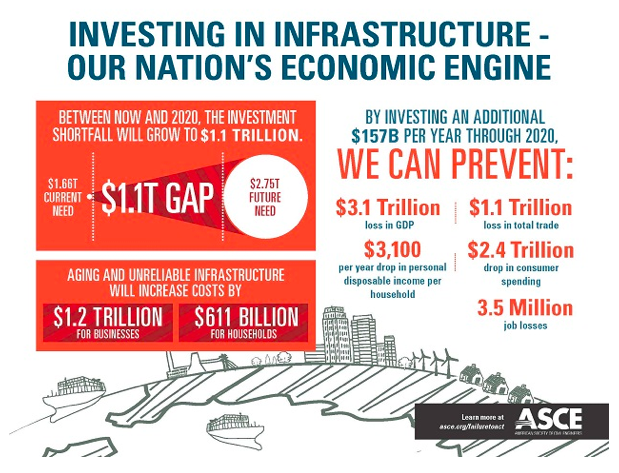

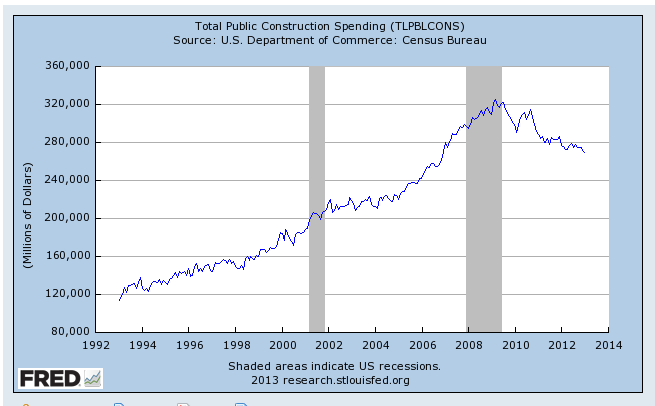

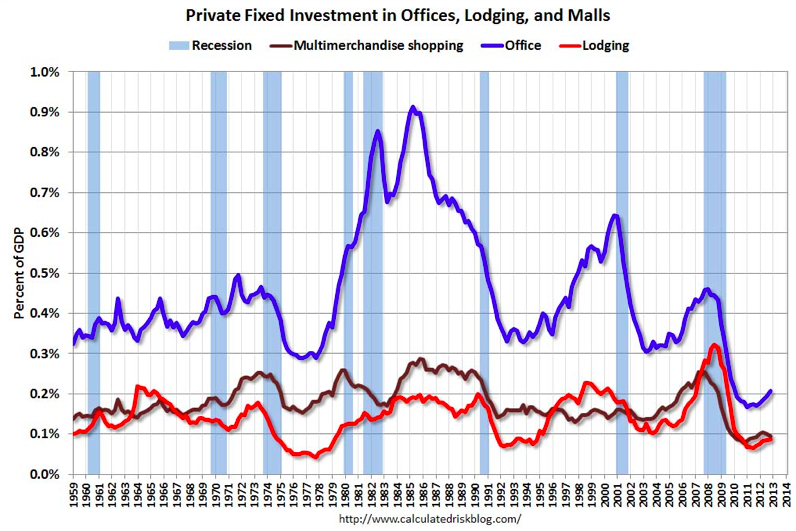

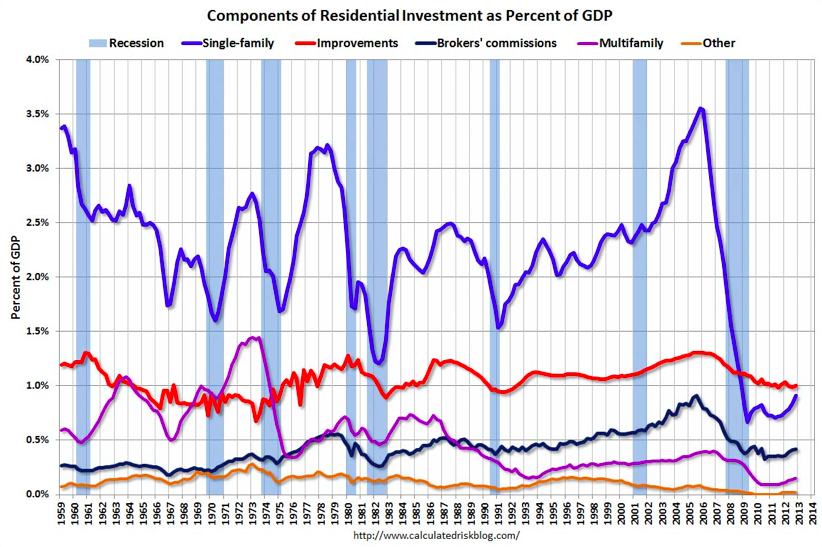

The entire is a very interesting read in terms of the shift underway from suburban corporate campuses to moving into high-rises. Read the entire article here. To answer the question posed in the title of this entry, we are apparently not investing in infrastructure, at least not in the ways we have in the past. Consider this graphic created by the American Society of Civil Engineers (ASCE): Now, I typically take these graphics from ASCE with a grain of salt. I mean, ASCE, as an organization that supports civil engineers (a group that has a huge stake in infrastructure spending), is at least partially biased towards demanding more infrastructure spending. But the graphic below shows that they're not totally crying wolf: Since peaking in 2009, public spending in infrastructure has declined, save a short-lived uptick that started in late 2009 due to the American Recovery and Reinvestment Act. I'm interested in this phenomenon because at a recent technical job fair at Sac State, the large general contractors that are involved in infrastructure construction where among those with the most open positions. This form of hiring (soon-to-be recent college graduates) leads me to believe that perhaps construction spending in infrastructure is likely to start picking up (or contractors expect it to). I hope this is the case, because if ASCE is not calling for a falling sky, we could be in deepening trouble if we don't improve our crumbling infrastructure. If funding is dramatically cut, as is a likely scenario if the sequestration comes to fruition, it will only get worse. So public investments in infrastructure have decreased since the recession. There is very little private investment in infrastructure (in comparison to public investment). So where is private investment in buildings going? Let's go to some graphs created by Bill McBride of the Calculated Risk blog: Capital investments in multimerchandise shopping centers (malls), office buildings, and lodging buildings have also declined since the recession. But there has been some positive growth in the past year or so in office and lodging building construction (malls have declined of recently after a slight recovery from 2011-2012; I have discussed the slowing growth in mall and big box retail construction elsewhere in this blog). The bigger story recently has been housing. After also falling off a recessionary cliff, housing has increased markedly over the past year or so, particularly in single family housing (multi-family less so, but still moving positively in the last year). That's where the money seems to be going. With little inventory and large amounts of institutional money moving into single family housing, interest in that market should continue to be strong (emphasis on the *should*). A recent down tick in residential construction needs further data to see if it's an actual trend, but it seems on the macro scale that that's where construction investments are positive.

The bottom line: infrastructure spending is declining in the big picture (local areas may be bucking the trend, and hence the hiring of college graduates), but private building construction is increasing, particularly in housing. Wow, it's been a few weeks since I last posted, so there's a lot to get caught up on. Some of this news is a bit stale, so I'll keep it brief.

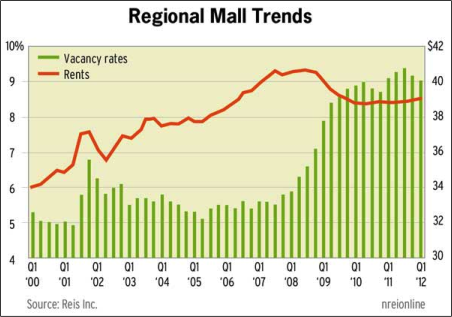

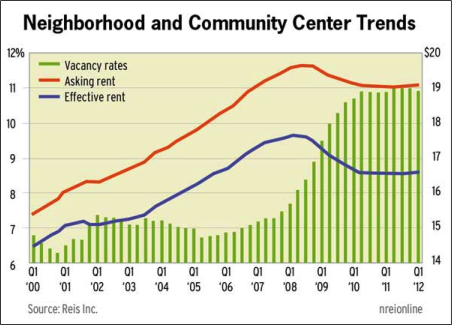

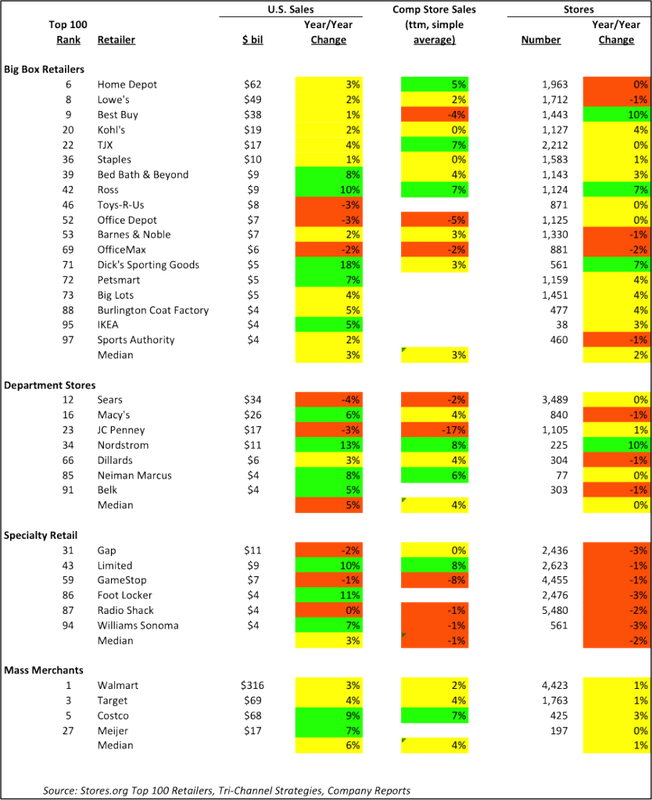

First, the sort of bad news: After going on a tear over 2012, the National Association of Homebuilders Housing Market Index (HMI) declined in February from 47 to 46. Any HMI less than 50 indicated that homebuilders see sales conditions for houses as poor (conversely, an HMI greater than 50 means the sales climate is good in the eyes of homebuilders). As I have said in the past, I'm not entirely interested in homebuilding as a sector of the construction industry, but it is a leading indicator for other types of construction (commercial, industrial, infrastructure, etc.). While a decrease is not good, it needs to be put in perspective: the HMI and number of housing starts increased crazily in 2012 (HMI in particular). It's not uncommon for markets to take a break. Let's wait to see if an actual downward trend emerges before hitting the panic button. More recently, it was reported that the price of lumber dipped slightly recently (it's around $400 per 1,000 board feet). Again, it has been going up over 2012 and this may just be a reaction to the small decline in HMI. A few months of data is still needed to see if this trend has staying power or if prices will start rising again. You can see how the price of lumber has changed over time here. The decline in prices may actually prompt corporations to start investing, and a recent headlines seem to indicate that's the case. Corporate capital spending plans have exceeded that predicted by Wall Street and have held up lately. The corporate spending on capital expenditures, or capex, includes offices, plants and machinery. This is the sector of the construction economy I am interested in because it's the one that hires the contractors most of the students that graduate with a Construction Management degree from Sac State will work for. Capex spending for 2013 is predicted to be the highest it's been in over the past four years. That's good news if it holds up, which leads me to... Any recovery, new or continued, is a function of sidestepping any issues tied to the sequestration. Hopefully our government will find some sort of palatable compromise so that we don't shoot our recovery in the foot. "I don't think we're overbuilt, I think we're under-demolished" -- Daniel Hurwitz, CEO of DDR, a commercial property owner and manager, talking about malls. I came across a blog post from Jeff Jordan, a Partner with venture capital firm Andreessen Horowitz. The gist of the post is in its title: "Why Malls Are Getting Mauled." Why would a venture capitalist be interested in malls? Because they fund online retailers (Jeff sits on the board of Fab.com and was previously a senior executive with eBay). Online retailers are the antithesis of malls. So even though Jeff is clearly rooting for online retailers in the online retailers vs. malls battle (if that can be billed as an actual battle), he presents some very compelling data. The data is interesting enough that Jeff expanded on his blog post in an article for The Atlantic Cites, which can be read here. There are three self-explanatory figures from the article that are worth showing here: To summarize the above three figures, malls are hurting. Rents are flat and vacancies are increasing. And it's not like it's going to get better soon, seeing as many of the retailers that inhabit malls are hurting. The growth prospects don't look good. Hence the opening quote from Daniel Hurwitz. Unless the weak malls and retailers are culled from the herd, traditional brick-and-mortor retail properties will suffer. If you are a contractor that specializes in mall construction or sees a healthy percentage of your billings come from mall or brick-and-mortor retailers, this is troubling news. The pace of construction in that market is likely to decrease further, that is unless growing retail trends in the United State reverse course. If you are a contractor that has pursued work from retailers like Mervyn's, Circuit City or Borders, you already know this.

On the flip side, online retailers continue to grab market share from brick-and-mortor retailers. So while the market is closing the door on physical retail space construction, it's opening one for all things associated with online commerce. (*Note: I'm not predicting the death of malls and other physical retail stores. They will survive. There will just be fewer of them as time goes on if current trends hold. With more sales going online and lower rents from physical stores, the economics will call for fewer physical retail stores, and hence, less investment in them. But it won't go to zero anytime soon. Plus, with vacancies going up, and spaces changing hands, there may be increasing opportunities for tenant improvements. I just wanted to make that clear) So what does working in online commerce look like for commercial builders? Well, instead of clients like Sears, Macy's or Home Depot, your clients will be Google, Amazon, Facebook, Apple, etc. Instead of expansive retail spaces split up for individual stores and large tilt-up buildings for big box retailers, projects will be office buildings filled with cubicles, high-tech warehouses with miles of automated conveyor belts for fulfilling orders, and server farms that hold gobs of data. Google has an estimated 1 million servers split over 40 locations, and they're building more. There will be much fewer marble entrances, water fountains, glass curtain walls and other fancy architectural finishes and much more electrical and HVAC components (server farms, for example, suck electricity and require a lot of cooling). I will be coming back to this topic in the future because it's a deep vein of conversation. Some topics I hope to cover soon include:

But for now, let's just acknowledge that the competitive landscape of retailing is shifting, so general building contractors and their trade partners must be prepared to shift with it. I thought I was done talking about real estate for 2012. But a wave of good news has been landing so I wanted to pass it along. Just to reiterate, my primary interest in the single family housing market is that it is an indicator of the health of the overall construction market and the economy in general. Very few of my students and industry friends are in the single family construction industry, but good health in that market generally points to good news in the market for other (bigger and more complicated) construction projects. I'll separate the news by date. See if you can detect the trend: December 20, 2012:

December 26, 2012

December 27, 2012

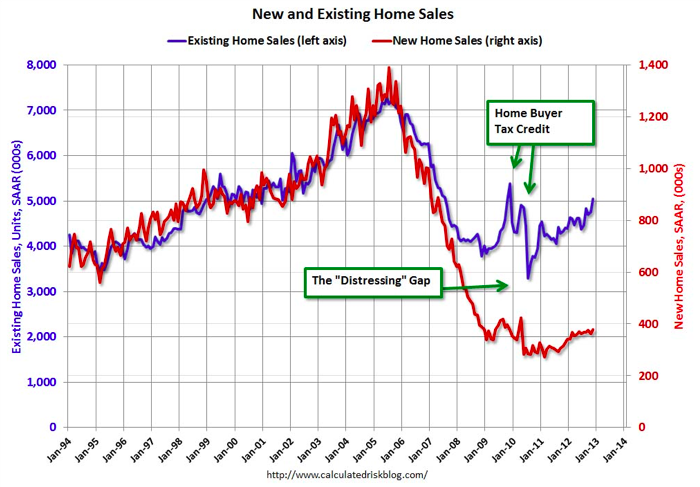

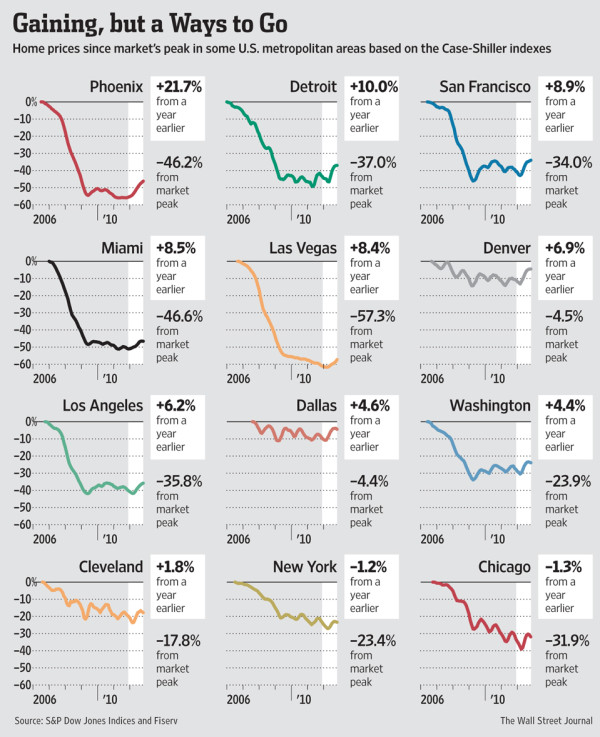

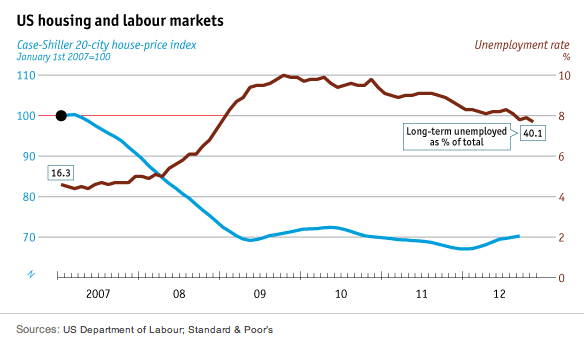

Existing home sales outpaced new home sales during the recession because many of the existing home sales were of distressed homes at bargain basement prices. New homes could not compete with the lower priced existing homes, so sales of new homes fell. As the number of distressed properties decreases, new home sales should increase, closing the "Distressing " Gap. This is good news for general contractors, because as new homes are built, so are adjunct buildings (schools, firehouses, retail, etc.). Other Miscellaneous Data: Looking at the two figures above, the Case-Shiller price index is getting better in most places in the U.S., particularly the places that were hit hardest during the downturn (Phoenix, Las Vegas, Miami, I'm looking at you). However, we are still a long way from the pre-recession peaks. The second figure I threw in this post because I found it interesting. It seems, at least from 2007 on, that the Case-Shiller index and unemployment are inversely proportional. So, if unemployment decreases, hopefully Case-Shiller will increase (sort of a master-of-the-obvious observation). OK, so what does all the data above show? It seems to indicate that the housing market is getting better. This would traditionally indicate that the economy is getting better and that construction activity should be increasing (institutional and commercial construction tend to lag housing). This should be good news for general contractors. Except... What's the bad news? Sorry, but we're not completely in the clear. In fact, there is a considerable amount of uncertainty in the market. It stems partly from:

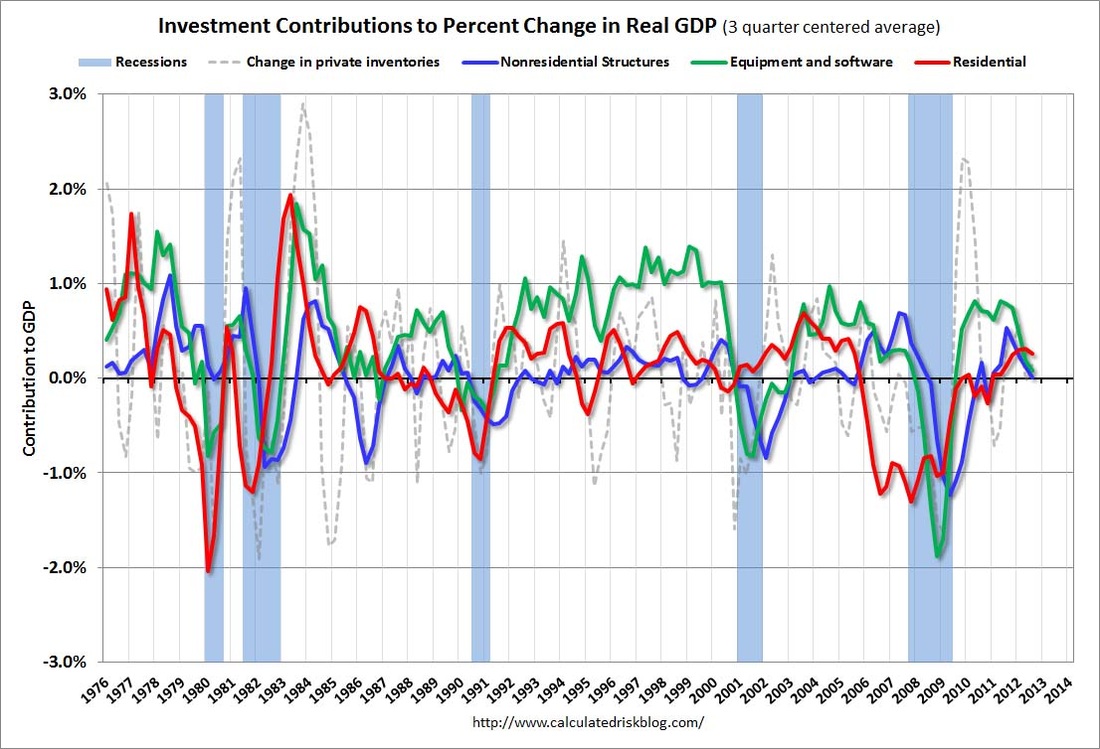

So the housing market looks like it's improving and the data supports that it is. But lurking in the background is a fragile economy (and we haven't even mentioned the fiscal cliff or any other external factors that could upset the market). If this housing market improvement has legs, then that's good news for the construction industry (and the economy as a whole). If it doesn't, well, we're stuck in the same slow construction market we're currently slogging through. I guess like many things in life, we'll just have to wait and see. But wait there's more! I want to leave you with one last figure, again courtesy of Bill McBride: The above figure shows the contribution to GDP from residential investment (which includes home building), equipment & software, nonresidential structures (what general contractors should be interested in), and "change in private inventories." These are the four categories of private investment. As discussed above (and in other posts), residential real estate tends to be a leading indicator of the economy and nonresidential structure investment is a lagging indicator (equipment and software is neutral). But this didn't happen in this recovery--housing has lagged. This was due to the inventory that grew so large during the recession (but has been slowly been whittling down). Perhaps this recent (2012) strengthening in the housing market is the indicator that the economy is getting stronger, all other signs weakness notwithstanding. If so, then expect the blue line in the figure above to reverse course, a trend that would be positive for general contractors. For Bill's full post on this (which is a very worthy read), click here.

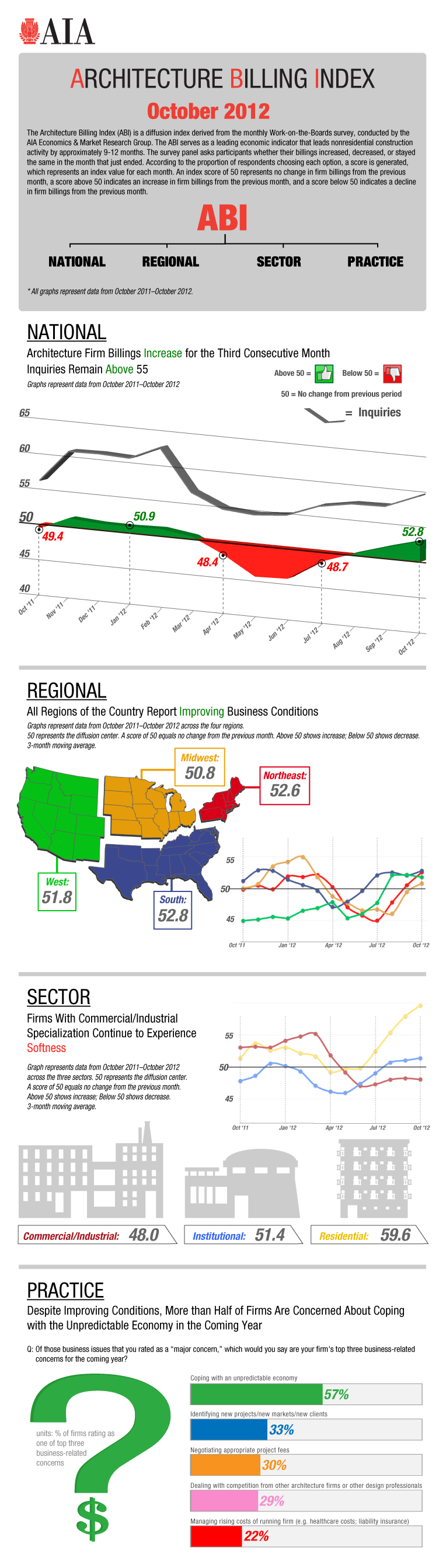

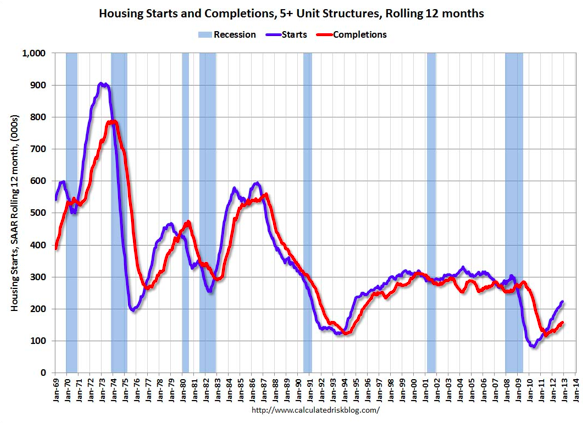

Just when I thought I was done for the year... A lot of news came out on the real estate and architectural markets, both of which are key leading indicators for the construction industry. Architectural Billings: AIA released its architectural billings index (ABI) for October today. ABI is considered a leading indicator for construction, typically leading construction activity by about a year (for more info, read this article). Here's the good news: The ABI composite was 53.2 in October, up from 52.8 in September (50 is the threshold between positive and negative billings). More good news: the ABI is above 50 across all regions in the United States. Even more good news: the ABI is above 50 in the institutional (think schools and hospitals) and residential (multi-family and high rise housing) markets. ABI for the institutional market is 51.4, up from 51.0 in September, while the ABI for the residential market is 59.6, up from 57.3 in September. But there is some bad news: the ABI for the commercial/industrial market is still below 50. Worse, it fell from 48.4 in September to 48.0 in October. Not a huge fall, but it still shows weakness. I wrote earlier today that the longer-term indicators that suggest the commercial real estate market is stabilizing and possibly getting better (note: this is my assessment of the commercial real estate market, not architectural billings or the construction industry). But in the near term, ABI is contracting for commercial/industrial projects, which means the construction industry surrounding the commercial/industrial market may still have some pain to experience. Below is the full take of AIA (full version can be found here and the press release can be found here):  As the bottom of the graphic shows (and I've mentioned plenty of times before), some of the weakness in the market is due to "uncertainty" in the economy. Corporations and large investment funds have tons of cash on the sidelines, but they won't invest it until they feel better. What will make them feel better is anyone's guess. Single Family Housing: I said earlier today that I wasn't as interested in single family housing because I'm more interested in projects that involve larger commercial general contractors. However, as previously mentioned, single family housing is a leading economic indicator for the U.S. economy in general (i.e. not just the construction industry). There was a lot of interesting data presented today. First the bad news (or maybe the not-as-good news). Mortgage applications decreased 12.3 percent from the previous week according to data collected by the Mortgage Bankers Association (see press release here). CoreLogic also tweeted that housing starts were down 3% in November (CoreLogic doesn't have any data backing that figure up on their webpage, but let's assume the tweet is correct). Taking both of these data points together (again, one I cannot fully substantiate), it shows that the housing market maybe showing some slight signs of weakness. Let me be clear: mortgage applications and housing starts are not the same thing. But housing starts and mortgage applications both are a function of demand. It could be that demand is slackening, at least in the recent past. The good news, however, is boffo good news. CoreLogic, in the same tweet (which again, the data behind it has not been substantiated) states that housing starts are up 27% year-to-date with strong growth in all regions with the exception of the Northeast. Bill McBride at the Calculated Risk blog states that housing starts are on pace to increase 25% in 2012 (I'm not sure where Mr. McBride got his data, but you can see his blog post here). Interesting, Bill goes on to point out that the 770,000 housing starts in 2012 will be the 4th lowest total since 1959, which is when the Census Bureau started collecting such data (the three lower years being those between 2009 and 2011). It shows we're emerging from a pretty big crater. Bill was full of interesting data today: The upper graph shows housing starts and completions for multi-family housing. There are two interesting takeaways from the data. First, the data is trending positively. Secondly (and this I'll admit I'm hoping my students will see) is that there is a one-year lag between starts and finishes. That's because it takes approximately one year to complete multi-family projects (obvious the size of the project/number of units also impacts the schedule).

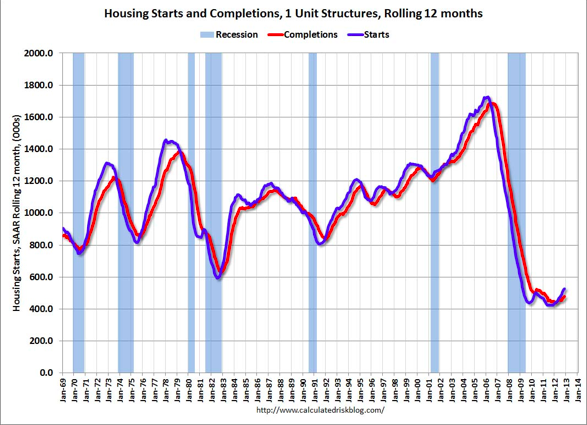

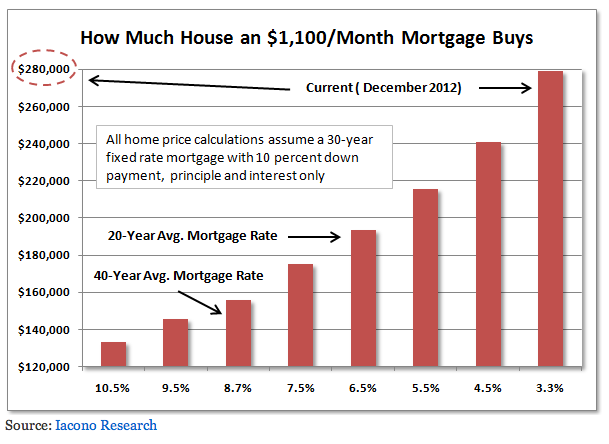

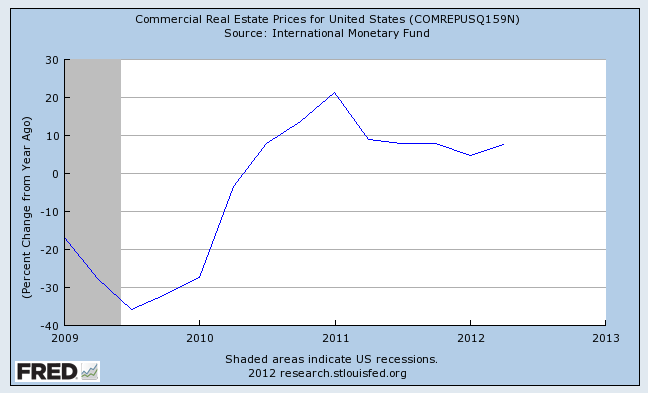

The second graph shows starts and completions for the single family housing market. It's also tending positively (albeit much more muted than multi-family). The lag between starts and finishes, however, is only six months which, not so coincidentally, is the approximate amount of time necessary to build a single family home. Bottom lines: 1) Architectural billings are up, and that's a good sign for the construction industry. There's still some weakness in the commercial/industrial market, but the other markets are positive and strengthening. 2) there is some recent signs of weakness in the single family housing market, but the last 12 months have been a home run. Hopefully these very recent trends are an anomaly, because as the housing market strengthens, confidence in the general economy increases. And that is also a good thing for the construction industry. I've been noodling on the real estate market for the past few months as I see it as a health indicator for the construction industry. As I have posted earlier, the housing market seems to heating up nicely. That's great for the economy as a whole, but I'm more interested in the types of construction projects that will get larger general contractors and their subcontractors working more. So how are those projects moving? Well, let's dig into that a little. Commercial Real Estate I am very curious about commercial real estate. I mean, if the housing market is moving in a positive direction, commercial building cannot be far behind it, right? The same low rates that are enticing people to buy houses are basically available to real estate developers as well. With borrowing rates low, you can build more space for the same loan size, as is represented in the figure below: I know, I know...the above is for home mortgages. But the same idea applies to borrowing for commercial real estate. Right now, you can build more space for the same loan payment, or so my thinking goes. But there in lies the rub. My thinking fails to grasp that there is still a glut of commercial space on the market. I spoke to two friends of mine in the commercial real estate market, and they say that development of new space will not increase until the level of vacancies decreases. Their take on this makes perfect sense, especially since we're in Sacramento which over-developed commercial space at a crazily drunken pace before the market crashed. Do the problems of Sacramento apply to the broader United States? Probably, but there are signs of life. Check out these graphs: The first of the three graphs shows data collected by the St. Louis Fed. Commercial real estate prices climbed rapidly until 2011 before steeply declining until end of Q1 2011. Since then, prices have been treading water, but they have ticked up positively in 2012 (this data only shows for Q1 2012, but even after taking the rose-colored glasses off, prices, at worst, have seemed to stabilize).

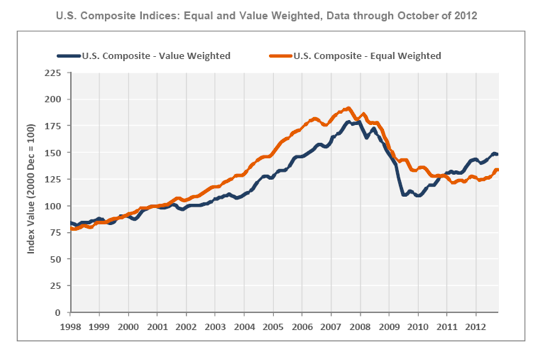

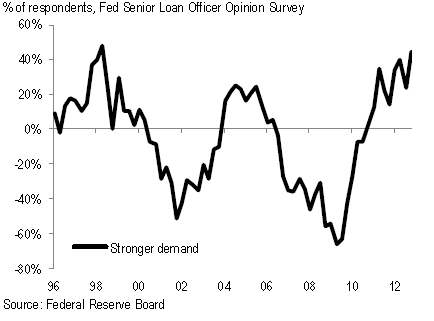

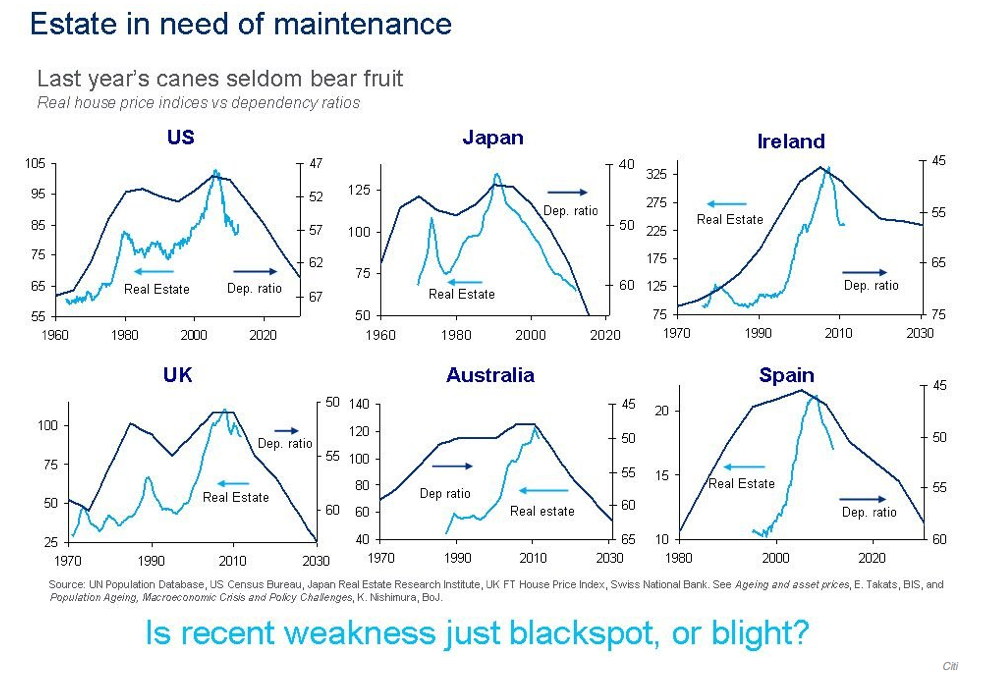

The second of the three charts (from the Calculated Risk Blog) shows the U.S. Composite Indices (last updated in October), which are two broad measures of aggregate pricing for commercial properties (you can find the whole article describing the indices here). It's subtle, but while prices decreased slightly in October, they are up quarter-over-quarter and year-over-year, and the Value-Weighted index is up 35% since bottoming out. I repeat, this is subtle, but the trends are positive. The last of the three graphs shows the results of a survey conducted with commercial real estate lenders by the Federal Reserve (see the chart and some analysis from Cullen Roche at the Pragmatic Capitalist blog). The demand for commercial real estate loans, which I would think would be a good indicator of projects to be developed, is trending positively. Lending activity is choppy over the past two years (probably due to general "market uncertainty"), but it is trending positively and is way off its low. So what does this mean? In the worst case scenario, commercial real estate prices are stabilizing, and in the best case scenario prices are increasing modestly. Lending activity is increasing. Taken together, I think this calls for cautious optimism for builders that commercial building will increase in the next year. Certainly, there will be pockets of strength (e.g. San Francisco/Oakland/San Jose Bay Area) and pockets of weakness (Central Valley of California, which interestingly enough, is not far from the Bay Area), but the general trends are slightly positive, generally speaking. Hopefully they stay that way or improve (duh, right?). Multi-Family/Mixed Use Development So the single family market is improving (due to declining inventory and low mortgage rates, among others), what about dense urban housing? I haven't collected any data (it's finals week and I'm swamped with grading), but I have collected four articles on large-scale projects in big North American cities. It seems that housing, while choppy, is always a good bet in big cities because the markets will rebound, particularly in the cities highlighted below: Washington D.C.: Developers are planning a 27-acre mixed use (1,300 residences, 960,000 SF or commercial space) in southwest D.C. (read more about it here and thanks to by friend Young Hoon Kwak for posting this link on Facebook). The developers are seeking $1.5 billion in financing, so it's not like they will be breaking ground tomorrow, but this is a good sign for commercial builders in D.C. Toronto: Toronto seems positively efforvescent in terms of high-rise construction, with 31 projects greater than 150 meters (almost 500 feet) slated to be completed by 2015. Check out the picture in this article. It looks like an Autobots vs. Decepticons battle featuring tower cranes. Hopefully this isn't the sign of a bubble...but it is a sign of commercial builders working! New York: More big building projects in the BK (that's Brooklyn for those of you unfamiliar with the rap game), this time with a 32-story residential tower on top of the newly-build Barclays Center (the house Jay-Z built and home of the Brooklyn Nets). This project is another piece of the massive Atlantic Yards redevelopment project. A cool feature regarding the construction of this project is that it will be completely pre-fabricated off-site and trucked into place. The general contractor is Skanska, and if you want to observe the future of the construction industry, watch this project. To read more about the project, check out this article. San Francisco: Last, but not least, check out what is being planned in SF. Lennar is planning on building over 20k housing units in the City's Hunter's Point, Candlestick and Treasure Island areas (all former U.S. Naval Bases and, I suspect, full of environmental hazards). What's unique about this project, besides the size and scope for an SF project? It is being funded by loans (to the tune of $1.7 billion) from China Development Bank and will be built by a Chinese general contractor, China Railway Construction Co. The project is expected to take 16 years to complete and will create an estimated 5,000 jobs. China has been investing in the U.S. government for years, but this combo of direct Chinese investments coupled with a Chinese builder is unprecedented. U.S. lenders and contractors should take note, as this project will likely be a signal of future trends (good or bad, depending on your perspective and the success/failure of the project). To read more, check out this article. So no scientific data, and certainly investments in those cities are, very relatively speaking, safe in any economic state due to the fact that they are major centers of commerce, so they cannot be used to draw broad conclusions. But they do show, anecdotally, that activity is picking up. An analyst for Citgroup, Matt King, created what he proclaimed "the most depressing slide I've ever created" and presented it a few days ago: Real estate prices are straight forward (and they're for single family houses). The dependency ratio is the proportion of people that are working age to those that aren't or, in other words, the ratio of people that can reasonably be expected to be working to those that can't. As the proportion of the population that isn't working grows relative the proportion that is, which is currently happening in much of the developed world because of the aging workforce (birth rates are dropping, so the dependency ratio is not due to more babies being born), real estate prices drop and are expected to continue dropping (for a bunch of reasons, one of which being that as retirees downsize their housing needs and there are not as many younger buyers remaining to buy the house they're moving from, causing housing prices to drop).

I get that it's a pretty simple slide that shows some trends, and I furthermore understand that correlation is not causation. As a home owner, it kind of scares me because most of my wealth is wrapped up in my house. But as a student of economics as it applies to the construction industry, I cannot help wondering what this slide means for the future of building homes. If the value of single family housing drops precipitously over the next decade or two, does that mean that single family homebuilding will also decrease on a relative basis? This is a big deal, as the largest segment of the construction industry is in the single family sector, and as goes single family housing, so goes the rest of the construction market. There may actually be a huge opportunity here, though. If you are a builder that specializes in multi-family housing, either apartments or high-rises, this could be great news. The population of the countries in the figure above, including the United States, isn't decreasing, it's just getting older. People will still need housing, just maybe not single family homes. The single family housing market is starting to heat back up, but that's due in large part to low mortgage rates, low supply and mass home buying by private equity investors (who will likely rent the homes, at least in the near term). Longer term, the cost of capital is going to go up (it can't get much lower and quantitative easing cannot go on forever). The conventional wisdom regarding home ownership as a solid investment is being challenged, notably by Nobel Prize winning economist Robert Shiller (see video here). And many people that would traditionally be the age of purchasing their first home are holding off on doing so (they're too busy paying off student loans). This doesn't inspire a great deal of long-term confidence in the single family housing market. But going back to what originally made me curious about this. If there is an opportunity for the developers and builders of multi-family housing projects, then that may spillover into other necessary construction projects. Like single family housing, multi-family housing will spur the construction of schools, retail space, hospitals, etc. But it may also spur big infrastructure investments, such as mass transportation projects. I'm guessing the face of housing will change dramatically over the next 20 years to the detriment to single family housing builders that fail to evolve, but that will create opportunities for other builders that are ready can respond to the change in the market. |

Archives

January 2024

Categories |

RSS Feed

RSS Feed