|

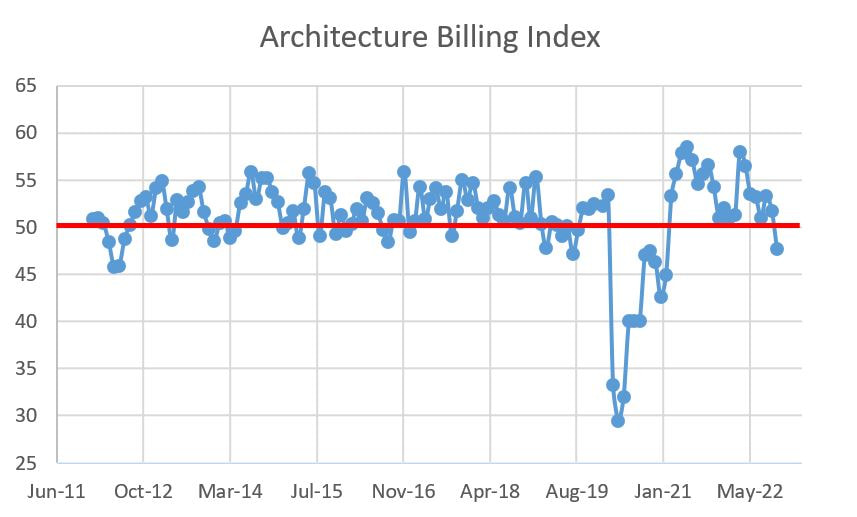

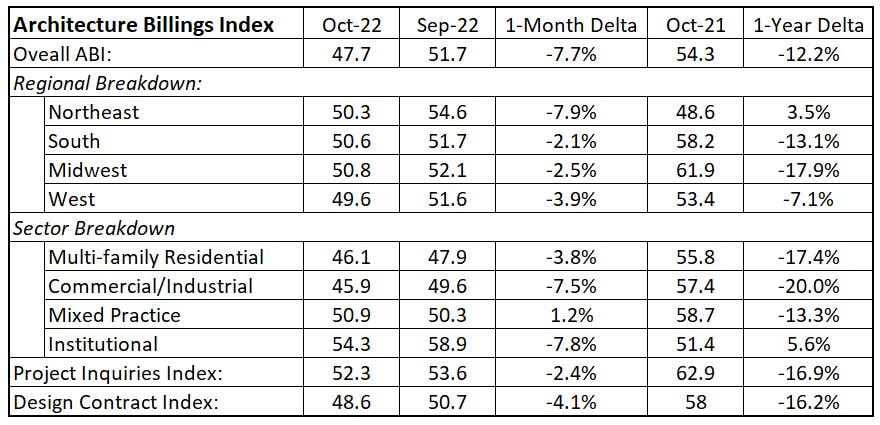

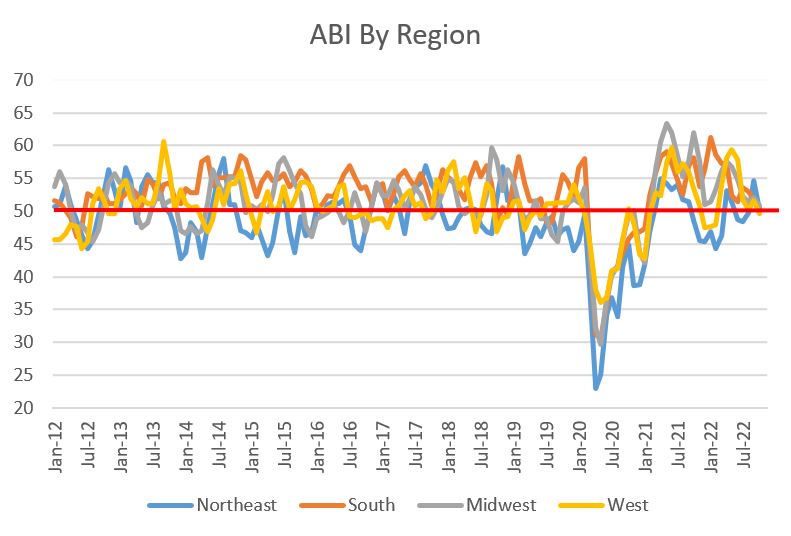

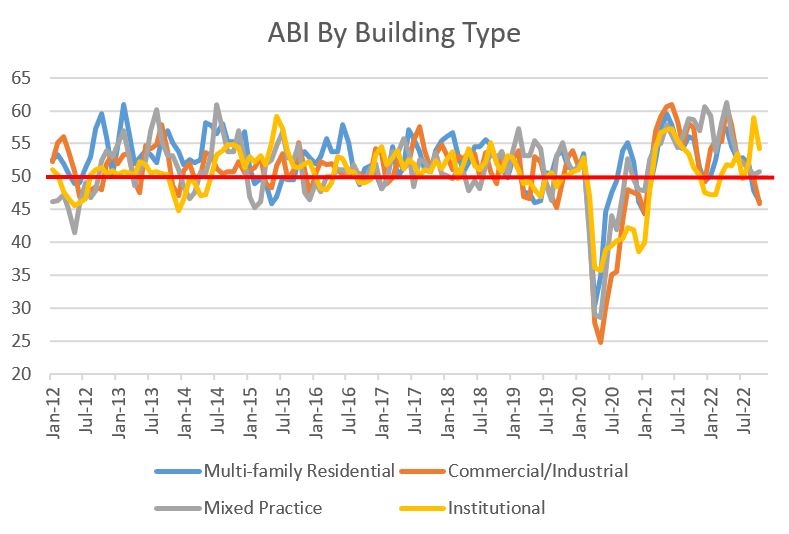

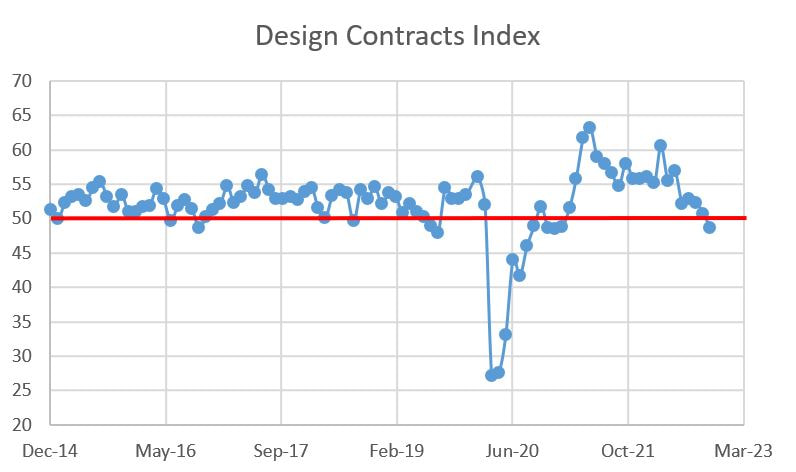

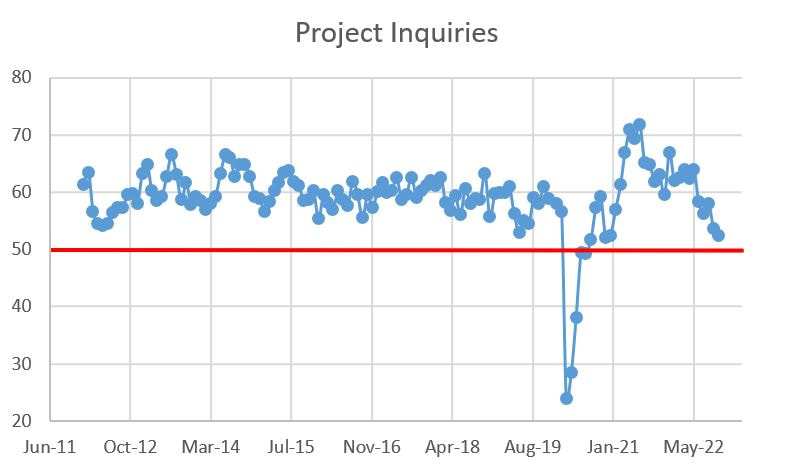

I tend to be a "glass-half-empty" type of pessimist. As such, the American Institute of Architects' (AIA) Architectural Billings Index (ABI) for October landing with a 47.7 handle would typically have me concerned about the wheels coming off the AEC industry wagon, but I am fairly sanguine about the measure. Before I explain why, let me restate that an ABI measures above 50 mean billings are increasing, while those below 50 signal a decrease. The ABI is a nine-to-twelve-month leading indicator of commercial building construction activity. Having said that, how can a measure of 47.7, particularly after falling from 51.7 the previous month, not leave me worried? Well, this decrease was totally predictable. If not this month, then sooner than later. Why? well, there are plenty of predictors that we are heading for a likely recession. My favorite indicator is the spread between 10-year and 2-year treasuries (AKA the 10/2 yield curve). While a lot of people will argue the validity of the 10/2 yield curve, it is a pretty good reductive predictor of recessions. Essentially, when the yields on short-tern treasuries (2-year) exceed the yields of longer-tern treasuries (10-year), the “smart money investors” are predicting tough economic conditions in the short term (hence the demand for a higher yield). Right now, the yield curve is bending strongly towards a recession. Notice how when 2-year yields exceed 10-year yields (a negative yield curve, or when the graph below goes below zero), a recession seems to follow (select "max" for time period; the grey bands in the figure signify recessionary periods). If you want to geek out over the validity/invalidity of the 10/2 yield curve, shoot me an email or DM. A more tangible measure in the increasing Fed funds rate. The Federal Reserve Bank has been increasing their funds rate in a stated purpose of cooling the economy (specifically reducing inflation). While the Fed funds effective rate does not seem that high from a historical perspective, when it is at zero for several years, any increase seems painful. Notice also that recessions (grey bands) tend to follow periods of increasing rates. Taking these economic indicators together over the past several months has braced us for an economic slowing, and hence a decrease in ABI. Having said all that, here are the details. Similar to last month, the pain is localized. In fact, the only regional ABI that was below 50 was in the West, and that 49.6 measure is not that bad. In terms of market sectors, Multi-family Residential has decreased for two months straight (and rather sharply to boot). Again, this is predictable as this sector is particularly susceptible to increasing interest rates. Institutional, in spite of a monthly decline, has remained relatively strong over the past year and this may be due to planned government spending on infrastructure (which includes auxiliary building construction). Design contracts and inquiries are both down sharply but inquiries are still above 50. In spite of my relative positivity, one stat that concerns me is that, with the exception of the Northeast and Institutional projects, the sub-category ABI measures for October are all below their 130-month averages. So the big question now is how long will this decline last? That is a tough question. While there are all these economic headwinds, some ginned up intentionally, there remains so much pent up demand for new buildings, especially housing. So if you are not buying my seemingly lack of panic, let me leave you with the news that construction starts accelerated 8% in October. The economy is behaving schizophrenically so be prepared for some wild gyrations over the next few months.

1 Comment

Jordan West

1/30/2023 10:41:18 am

Yo! Where's our January update? It seems things are slowing here in LA and pretty much have only heard from a few people about construction slowing as a whole but I wanted to see what your opinion was on all of this.

Reply

Leave a Reply. |

Archives

January 2024

Categories |

RSS Feed

RSS Feed